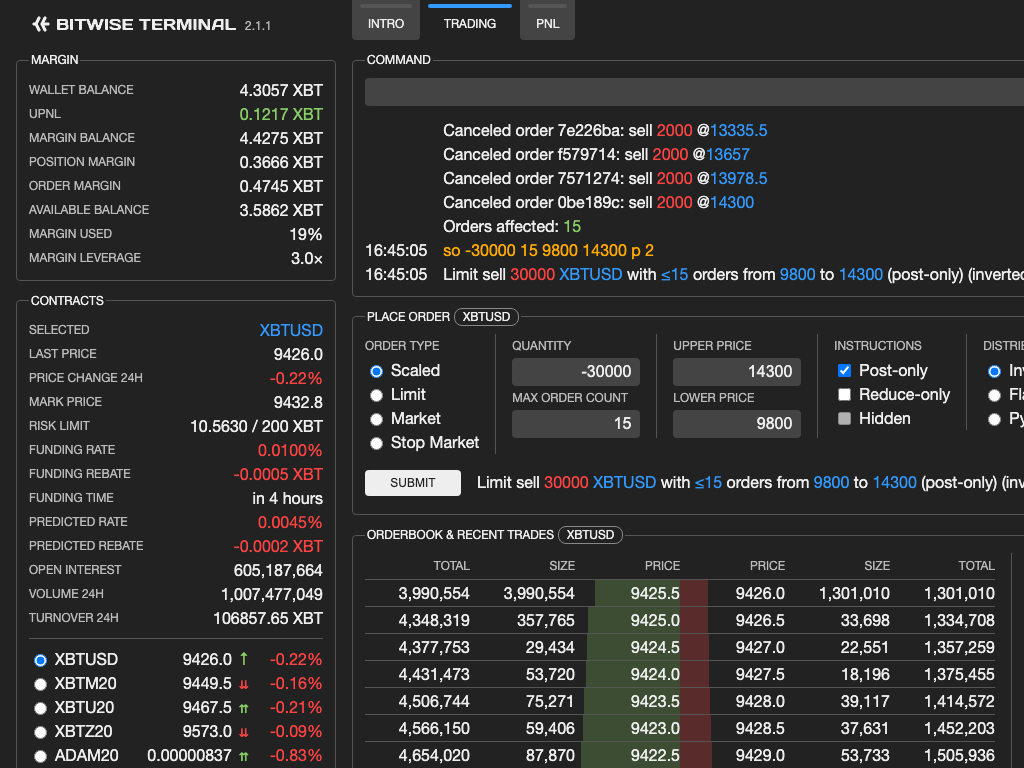

Bitwise Terminal trading interface

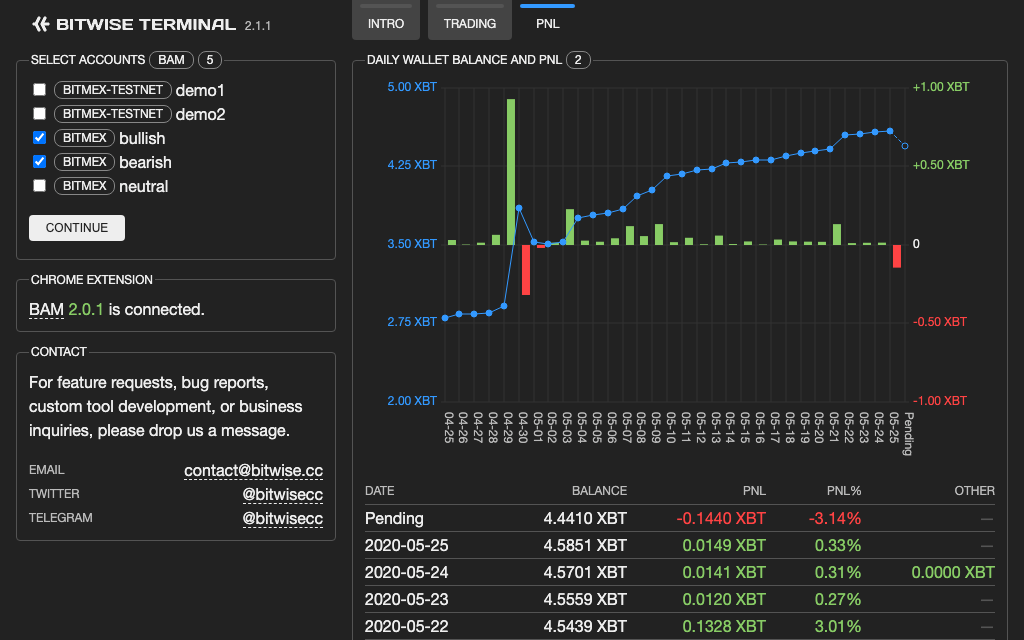

Bitwise Terminal is a web-based crypto derivatives trading platform that executes trades efficiently and privately. It currently supports BitMEX and BitMEX testnet. Bitwise Terminal also helps traders easily track PNL and wallet balance of multiple accounts.

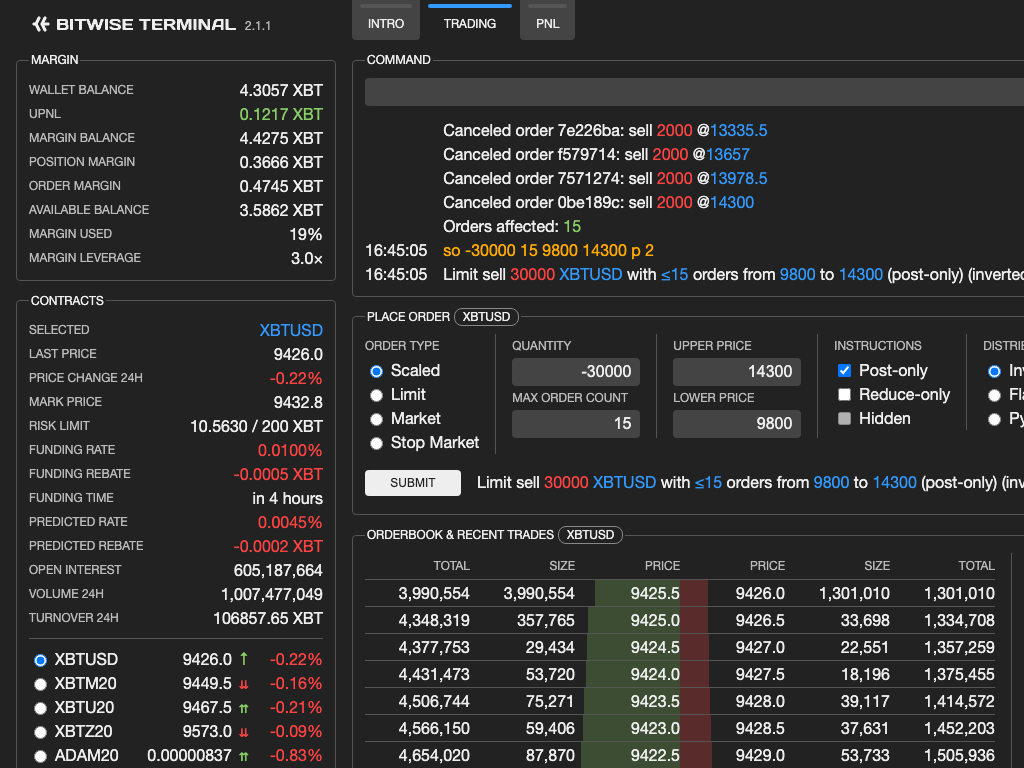

Bitwise Terminal trading interface

Bitwise Terminal PNL tracking interface

No sign-up or payment is required to start using Bitwise Terminal. All you need to prepare is an API key created on BitMEX or BitMEX testnet.

Bitwise Terminal’s unique command line interface empowers you to complete tasks much faster than you could on BitMEX. As a complement to the CLI, a form-based GUI is also provided to help construct complex commands.

When the cursor is inside the command line input, you may press UP or DOWN to cycle through the command history.

| Category | Command | Summary |

|---|---|---|

| Contract | c | select contract |

| lv | set leverage | |

| rl | set risk limit | |

| Shortcuts | eth | select ETHUSD |

| xbt | select XBTUSD | |

| xrp | select XRPUSD | |

| Order creation | lo | create limit order |

| mo | create market order | |

| smo | create stop market order | |

| so | create scaled orders | |

| Order cancellation | ca | cancel all orders |

| cb | cancel all buy orders | |

| co | cancel specific orders | |

| cs | cancel all sell orders | |

| Order amendment | ap | amend price |

| asp | amend stop price | |

| aq | amend quantity | |

| Position closing | lc | limit close |

| mc | market close | |

| Meta | /c | clear logs |

| /h | display help message |

Arguments in angle brackets are <required>, and those in square brackets are [optional].

| Contract |

|---|

| c <contract> Select contract by name (case-insensitive, default: XBTUSD). |

| lv <leverage> Set leverage for the current contract. Pass 0 as leverage to enable cross margin. |

| rl <limit> Set risk limit to limit XBT for the current contract. |

| Shortcuts |

| eth Select the contract ETHUSD (shorthand for "c ethusd"). |

| xbt Select the contract XBTUSD (shorthand for "c xbtusd"). |

| xrp Select the contract XRPUSD (shorthand for "c xrpusd"). |

| Order creation |

| lo <quantity> <price> [instructions] Create a limit order at price.Pass a positive quantity for longs, or a negative one for shorts.instructions can be empty (default), p (post-only), h (hidden), r (reduce-only), or a combination of the options (e.g. pr, hr). |

| mo <quantity> Create a market order. Pass a positive quantity for longs, or a negative one for shorts. |

| smo <quantity> <stop-price> [instructions] Create a stop market order at stop-price.Pass a positive quantity for longs, or a negative one for shorts.instructions can be empty (default, triggered on mark price), l (triggered on last price), i (triggered on index price), c (close on trigger), or a combination of the options (e.g. lc, ic). |

| so <quantity> <max-order-count> <lower-price> <upper-price> [instructions] [distribution] Create scaled orders with at most max-order-count limit orders from lower-price to upper-price.Pass a positive quantity for longs, or a negative one for shorts.instructions can be empty (default), p (post-only), h (hidden), r (reduce-only), or a combination of the options (e.g. pr, hr).distribution is either empty (default: 1) or a number between 0.1 and 10, which specifies the ratio of the order size at upper-price to the size at lower-price. Leave it empty or pass 1 to create a flat distribution with identical order sizes; pass a number between 0.1 and 1 to create a pyramid-shaped distribution; or pass a number between 1 and 10 to create an inverse-pyramid-shaped distribution. |

| Order cancellation |

| ca Cancel all orders of the current contract. |

| cb Cancel all buy orders of the current contract. |

| co <order-id ...> Cancel open orders of the current contract with matching IDs or ID prefixes. An ID prefix must be at least two characters long. |

| cs Cancel all sell orders of the current contract. |

| Order amendment |

| ap <amended-price> <order-filters> Amend price of matching orders of the current contract. amended-price is either an absolute price or a relative price change which starts with + or -.

amended-price can also be a percentage change if it ends with %.order-filters is a space-delimited list of order IDs, ID prefixes, b (buy orders), s (sell orders), or a (all orders). |

| asp <amended-stop-price> <order-filters> Amend stop price of matching orders of the current contract. amended-stop-price is either an absolute price or a relative price change which starts with + or -.

amended-stop-price can also be a percentage change if it ends with %.order-filters is a space-delimited list of order IDs, ID prefixes, b (buy orders), s (sell orders), or a (all orders). |

| aq <amended-quantity> <order-filters> Amend quantity of matching orders of the current contract. amended-quantity is either an absolute order size or a relative quantity change which starts with + or -.

amended-quantity can also be a percentage change if it ends with %.order-filters is a space-delimited list of order IDs, ID prefixes, b (buy orders), s (sell orders), or a (all orders). |

| Position closing |

| lc <price> Close the current position with a limit order at price. |

| mc Close the current position with a market order. |

| Meta |

| /c Clear logs. |

| /h Display help message. |

The quantity argument supports k as an abbreviation for thousands and m for millions.

For example:

25000 = 25k

-1000 = -1k = -k

-2500000 = -2500k = -2.5m

1000000 = 1m = m

-100000 = -0.1m = -.1m

The price argument supports relative price notation.

For example:

a = the lowest ask price

b = the highest bid price

a+0.5 = the lowest ask price plus 0.5

b-3% = the highest bid price minus 3%, rounded to the nearest tick size

2.4

aq to amend order quantity in bulkap to amend order price in bulkasp to amend order stop price in bulk2.3

2.2

mc to close a position with a market orderlc to close a position with a limit order2.1

2.0

so and GUI to create scaled orderssmo and GUI to create stop market orderslv to set leveragerl to set risk limit1.2

1.1

1.0